Time-to-value analysis: Efficiency in BlackLine

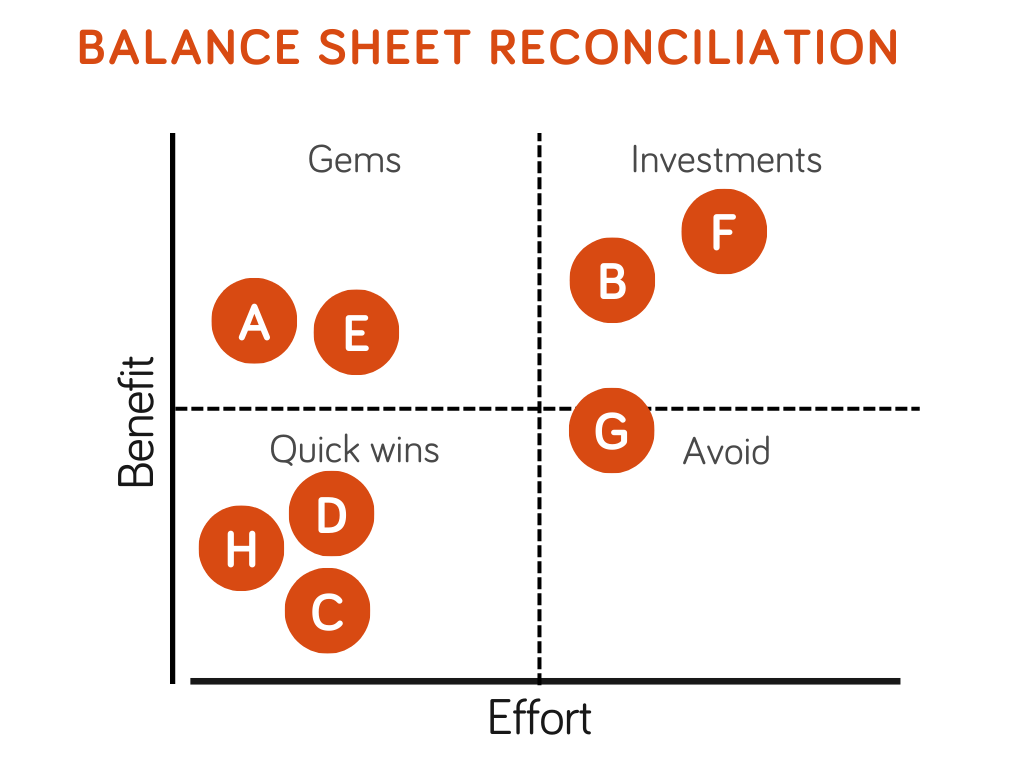

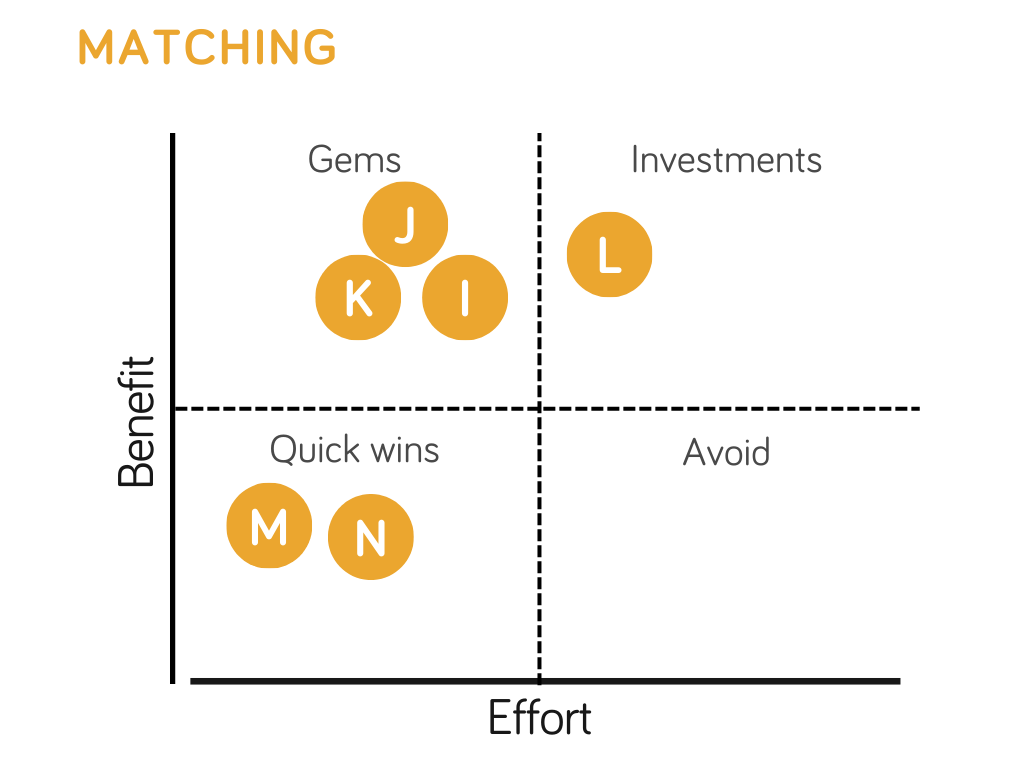

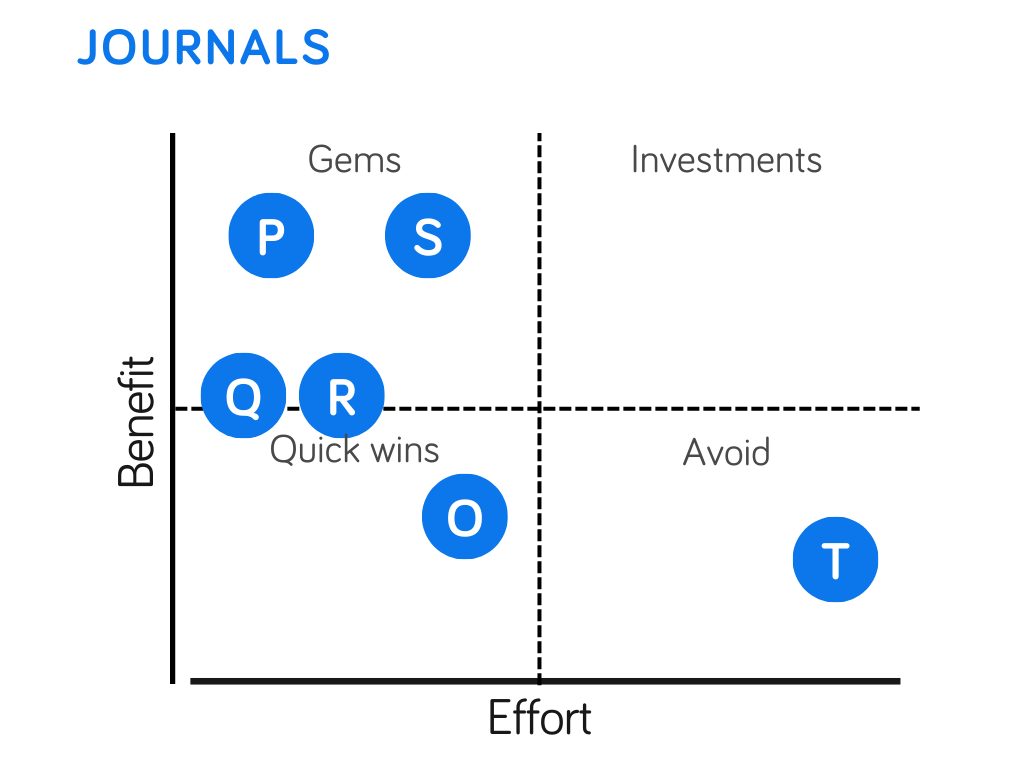

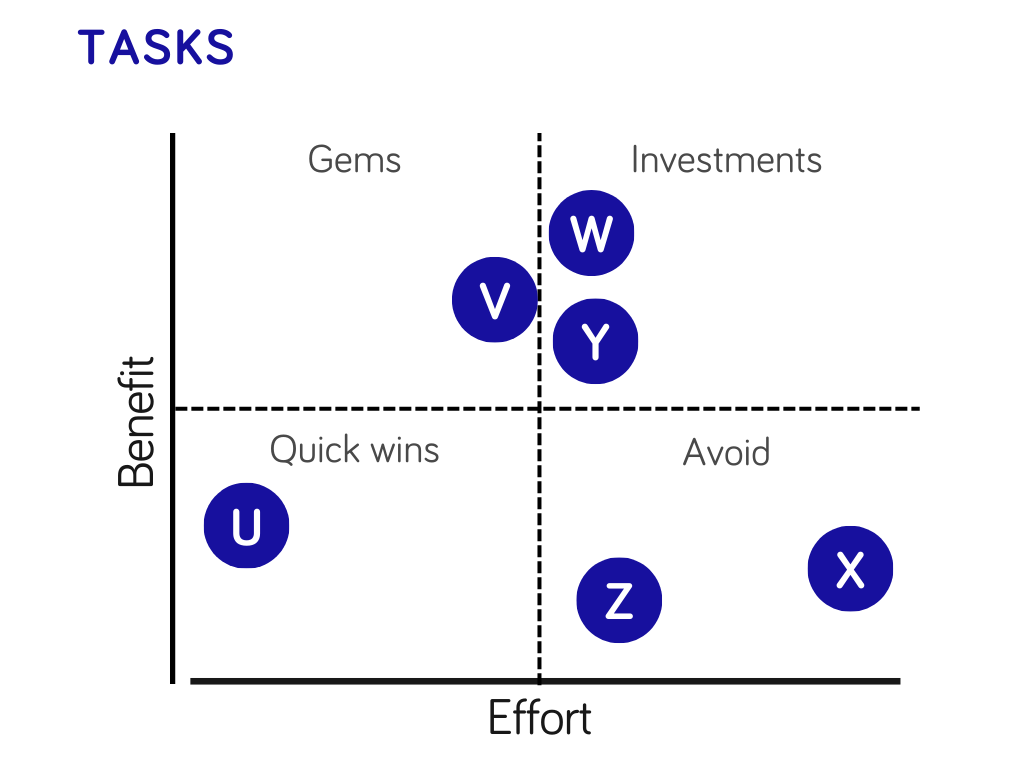

Understanding how different activities in BlackLine—and the level of effort to implement them—affect your close process is crucial to user adoption, stakeholder buy-in, and overall satisfaction in the technology. We’ve broken out 4 key modules to help you understand quick wins, what to avoid, where to make investments, and what to prioritize as you digitize your workflows.

A. Standard BlackLine business rules (e.g., ZBA)

B. Data integration balance matches (e.g., AR)

C. Risk ranking and frequency alignment

D. Auto certification from BlackLine templates (e.g., prepaid)

E. Defined reconciliation thresholds

F. Development of all possible subledger integrations/extracts (e.g., AR, FA)

G. BlackLine’s rules-based administration (e.g., assign new account attributes)

H. Technology-enabled reconciliation policy

I. Single source matching for clearing/suspense ergogenic

J. OIM complementary matching and clearing integration—especially for SAP

K. Dual source matching (e.g., cash disbursements, payroll processors)

L. Focus on source system transactions (validated against summary general ledger posting)

M. Automated certification following transit rules

N. Matching rules based on business requirements, managed by confidence level—level of effort can vary

O. Defined approval logic

P. Posting thresholds

Q. Journal Entry Masters (recurring logic) integrated to Tasks

R. Journal entry integration to reconciliations for amortization/schedule journals via Automated Journal Definitions (AJDs)

S. Journal entry integration to matching for unmatched items or transaction data source (e.g., bank charges via AJD)

T. Process specific AJD, data flow from data pull, logic based analysis, systematic output, AJD to post

Ready for more? Learn about the dashboards that can take your data to a new level.