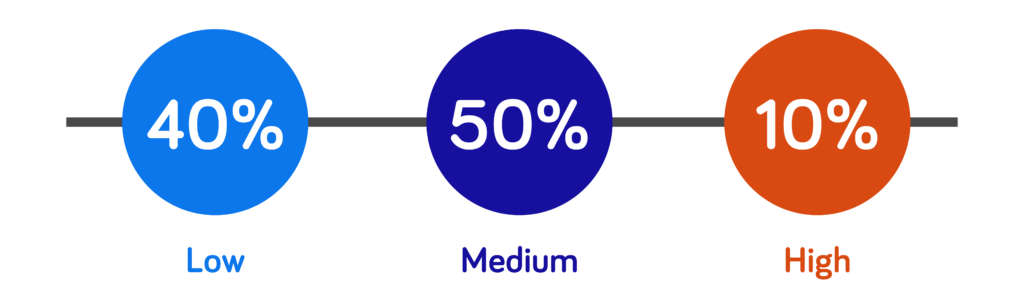

Target percentages: Risk ranking

Leveraging insight from hundreds of organizational interactions, here are the target percentages of your accounts that should fall within low, medium, and high-risk categories.

High risk attributes

Risk to financial statements

Significant work to reconcile, posing a material misstatement risk to the balance sheet

Considerations

- Balance is consistently significant to the balance sheet (materiality)

- High volume or unusual transactions

- Highly judgmental (valuation allowances, significant accruals)

- Aged items

- Multiple systems interfacing to the general ledger (GL)

- High volume manual journal entries and multiple teams/processes using GL Account

- System interface is reliant on manual processes for proper classification

Types of accounts

Cash, accounts payable, accounts receivable

Frequency

Monthly

Preparer due date

End of period

Approver due date

End of period

Target % of accounts

10%

Medium risk attributes

Risk to financial statements

Insignificant material misstatement risk, but may require additional oversight

Considerations

- Balance is consistently significant to the balance sheet (materiality)

- Low volume of transactions, high dollar amounts

- History of errors/out-of-period adjustments related to account

- Business unit is not integrated in systems

- System interface with manual entries

- Moderate level of manual journal entries

Types of accounts

Fixed assets, accumulated depreciation, accrued expenses

Frequency

Monthly

Preparer due date

End of period

Approver due date

End of period

Target % of accounts

50%

Low risk attributes

Risk to financial statements

Little work to reconcile, and little material misstatement risk

Considerations

- Balance is consistently insignificant to the balance sheet (materiality)

- Low volume of transactions, low dollar amounts

- No estimates

- Sufficiency of subledgers in fully supporting reconciliation

- Limited or no systems directly interfacing with GL

- Low volume manual journal entries

Types of accounts

Goodwill, Foreign currency translation adjustments, Non-current assets

Frequency

Quarterly

Preparer due date

End of period

Approver due date

End of period

Target % of accounts

40%

Want to learn more about risk ranking? Explore the 4 value drivers.