Common close improvement activities

Every organization and situation is different. But when it comes to closing the books, there are a few common ways to simplify your processes. Here are the key improvement areas we’re seeing across the companies we work with:

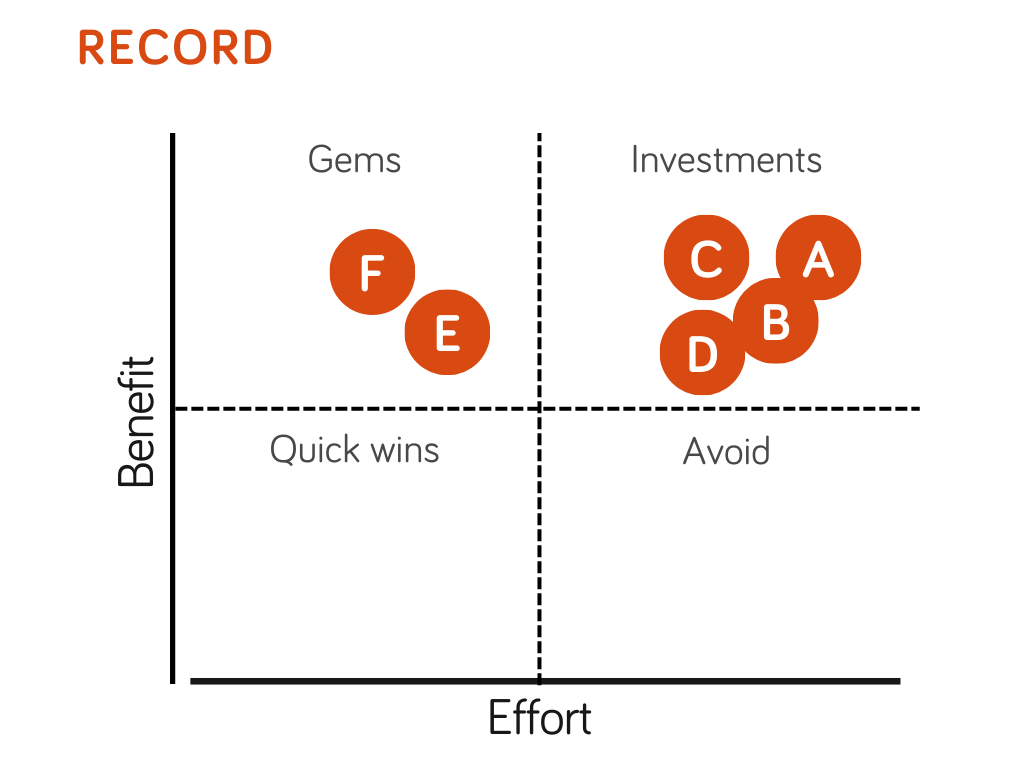

A. Sunsetting legacy transaction processing systems and integrate into ERP

B. Redesigning chart of accounts (COA) and implementing master data governance

C. Automating rules-based processes with RPA or migrating to SSC / BPO

D. Redesigning processes for intercompany transaction processing

E. Accelerating subledger cut-offs

F. Enforcing transaction processing during the month (not waiting until month-end)

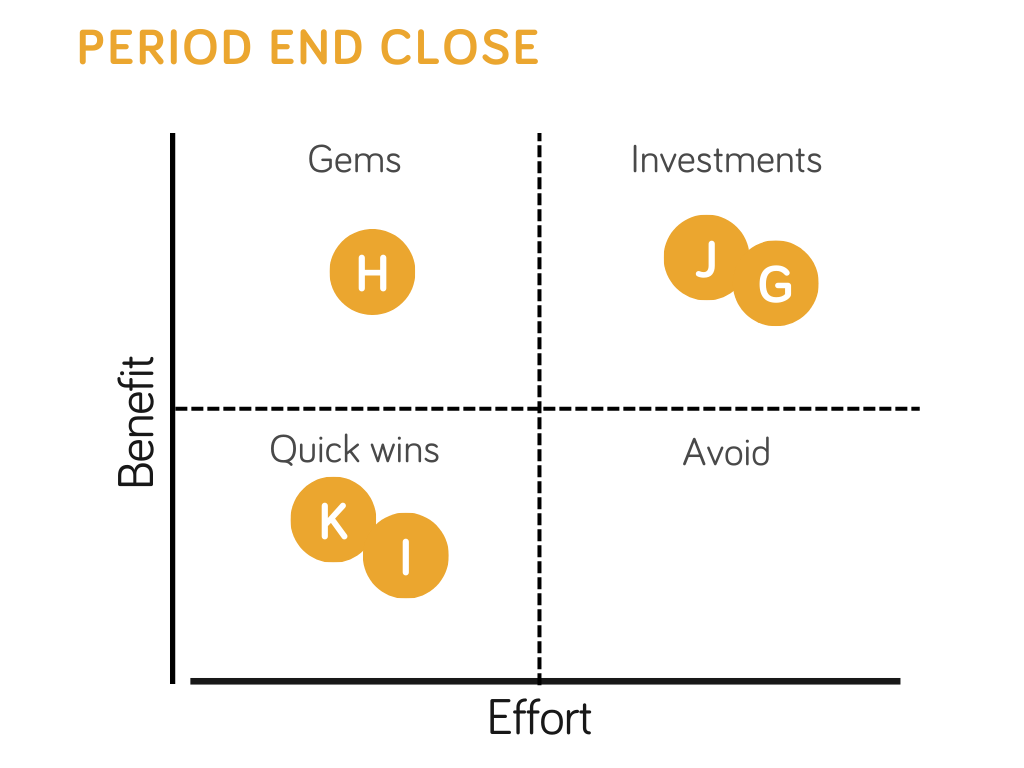

G. Assigning chart of accounts mapping responsibility to each entity with pre-close test submissions

H. Updating materiality thresholds for adjusting entries, reconciliations, variance explanations, etc.

I. Simplifying logic for accrual calculation and accelerated posting

J. Automating rules-based processes with RPA or migrating to SSC / BPO

K. Creating dashboards to monitor performance and enforce deadlines

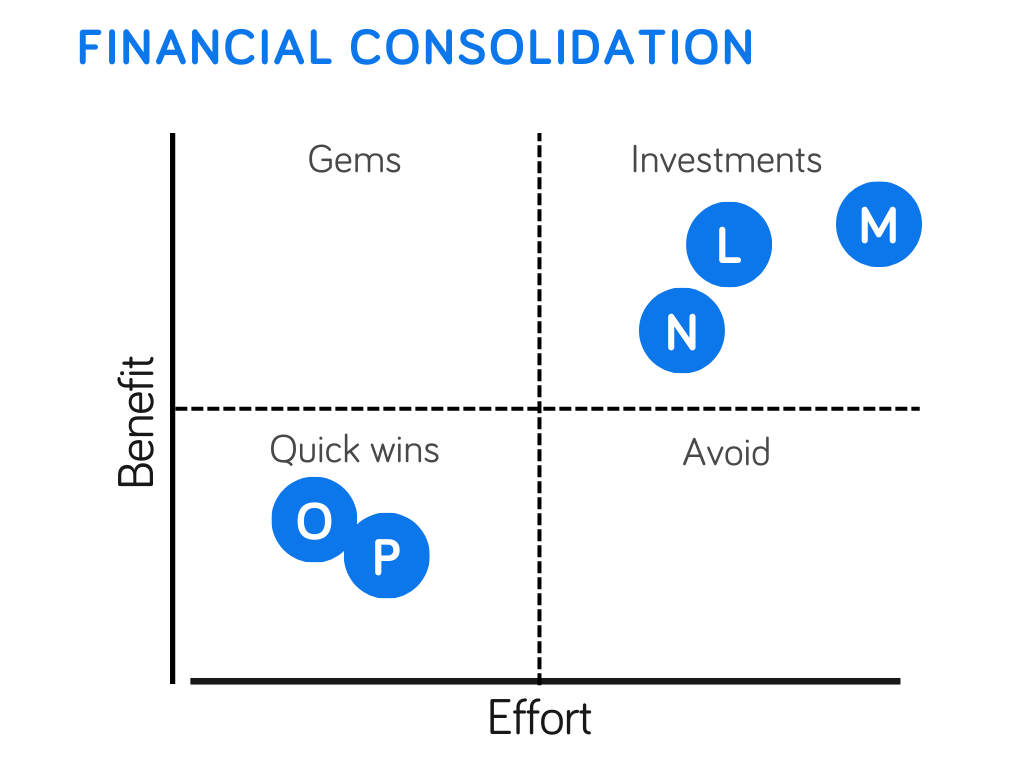

L. Using financial consolidation systems to the full extent of automation

M. Redesigning the intercompany profit elimination process

N. Establishing a single consolidation for all trial balances direct from each entity

O. Eliminating recurring top-side journals by pushing corrections to source ledgers

P. Increasing materiality thresholds for top-side journals through the close cycle

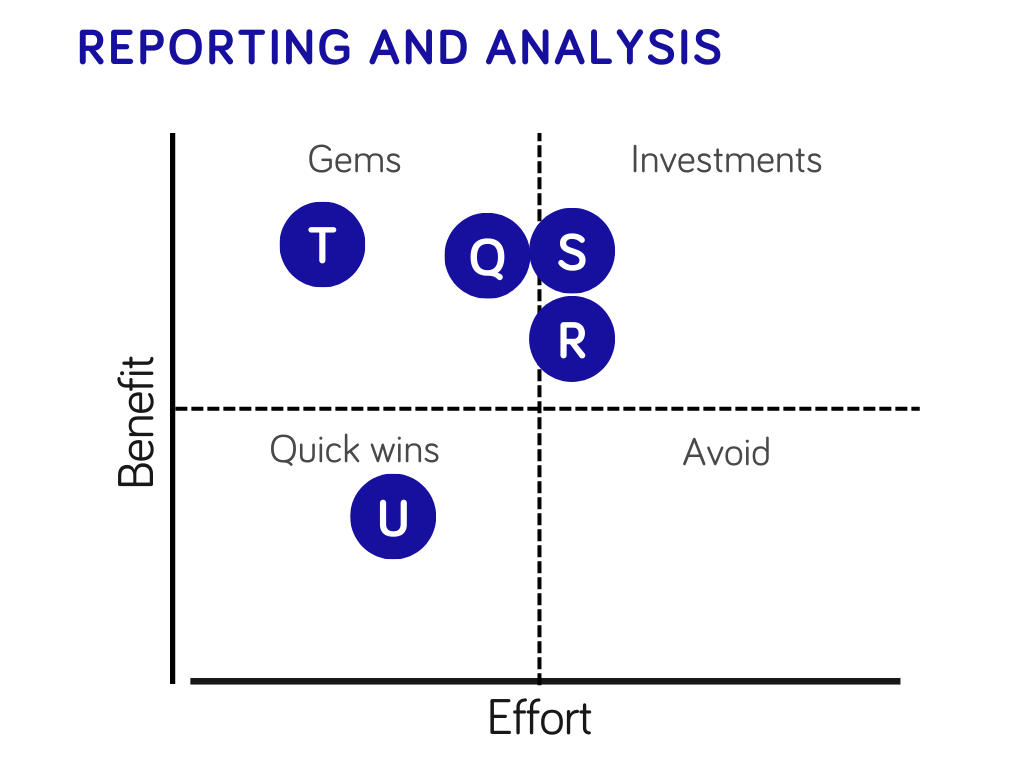

Q. Defining standard reporting package and eliminating redundant and unused reports

R. Developing reporting processes to support efficient FX impact analysis

S. Automating Statement of Cash Flows

T. Streamlining variance analysis by prioritizing time scenarios (QTD, YTD) and comparisons (prior M, prior year M, prior YTD, etc.)

U. Working with downstream stakeholders to satisfy data needs and timing

Ready to improve your close processes but want to define a tactical game plan for how to get there? Explore our Rapid Close Assessment.